NEW APPLICATION

Introduction to ARX Quantitative Trading System

In this world of information overload and emotional excess, Pascal Capital uses a methodology, a humanistic rationality, and a team of resolute practitioners to create a rare sense of order for our clients.The ARX system is just a tool. What we truly entrust is reason, time, and trust.We accompany every client—not just managing assets but managing the future.

MEET US

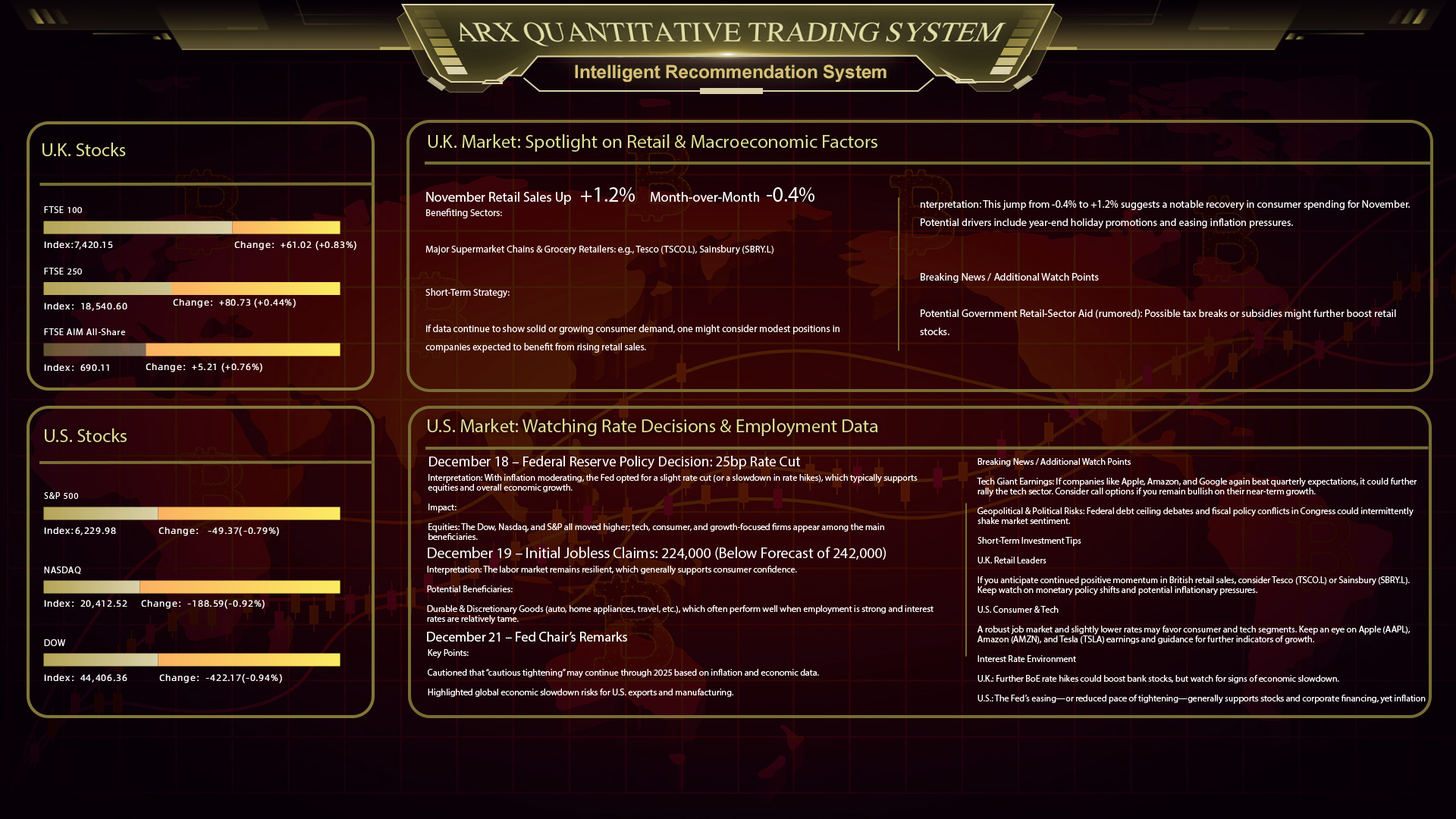

Feature 1: Intelligent Recommendation System

In the age of information overload, ordinary investors often struggle to filter through vast amounts of data and may overlook critical information. Without professional tools and analytical capabilities

NEW SERVICE

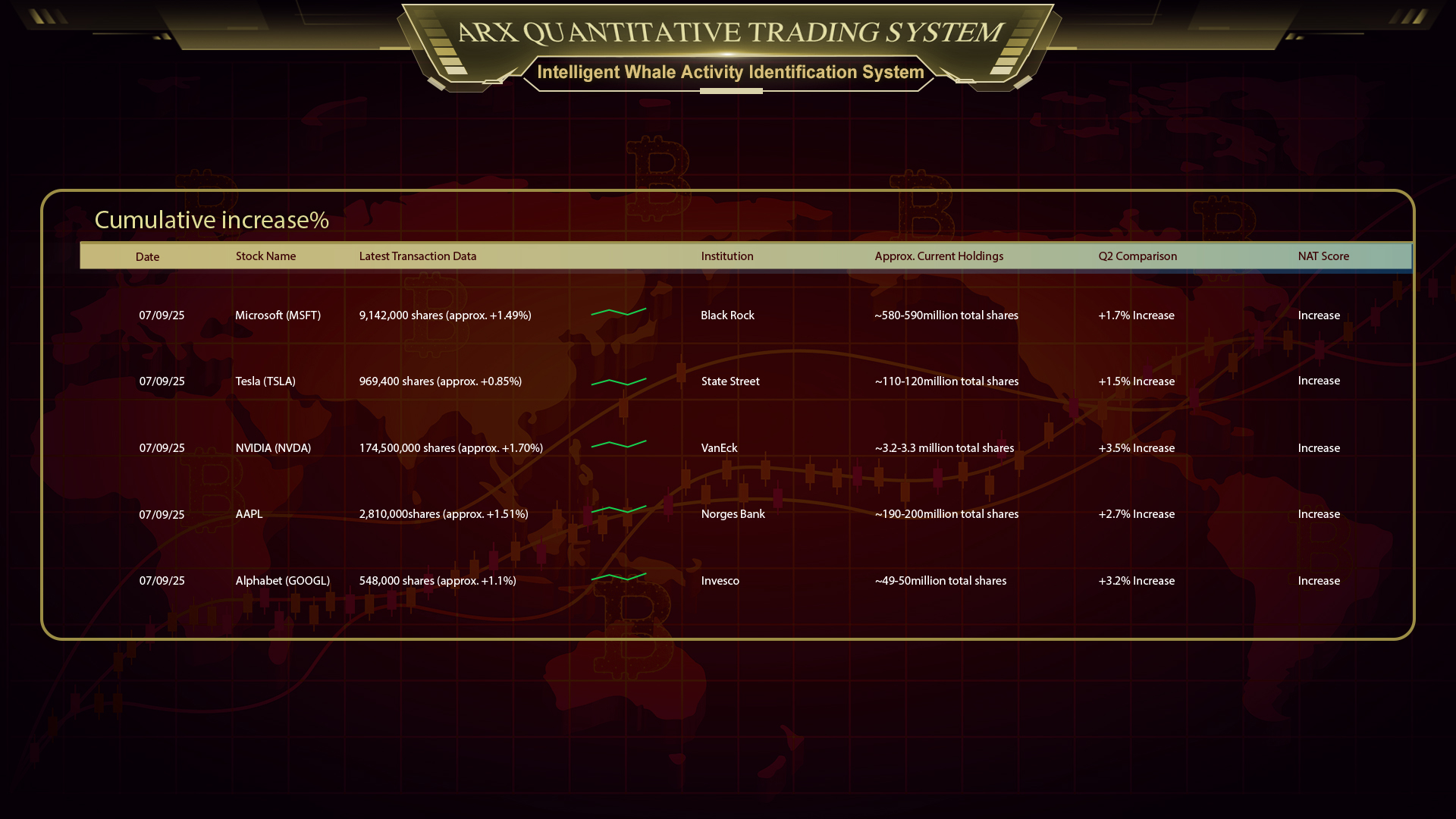

Feature 2: Intelligent Whale Activity Identification System

Traditional finance faces challenges such as data silos, limited traceability, and scattered interfaces, making it difficult to effectively analyze institutional capital flows and market intentions, limiting practical value.

MEET US

Feature 3: Quantitative Strategy Management System

Traditional trading software often suffers from complex settings, excessive indicators, and unintuitive interfaces, making it easy for ordinary users to misuse or overlook key parameters, which impacts analysis and decision-making efficiency

NEW SERVICE

Feature 4: Emerging Asset Identification System

When evaluating IPOs, IEOs, and other innovative assets, ordinary investors often face information asymmetry due to a lack of professional analytical methods. This can lead to missed high-potential opportunities or exposure to high-risk losses.

MEET US

Feature 5: Daily Selection System

New investors often feel overwhelmed by the sheer number of potential investment targets. Lack of experience and information overload can make it difficult to identify opportunities, leading to time-consuming analysis, hesitation, and missed returns.

NEW SERVICE

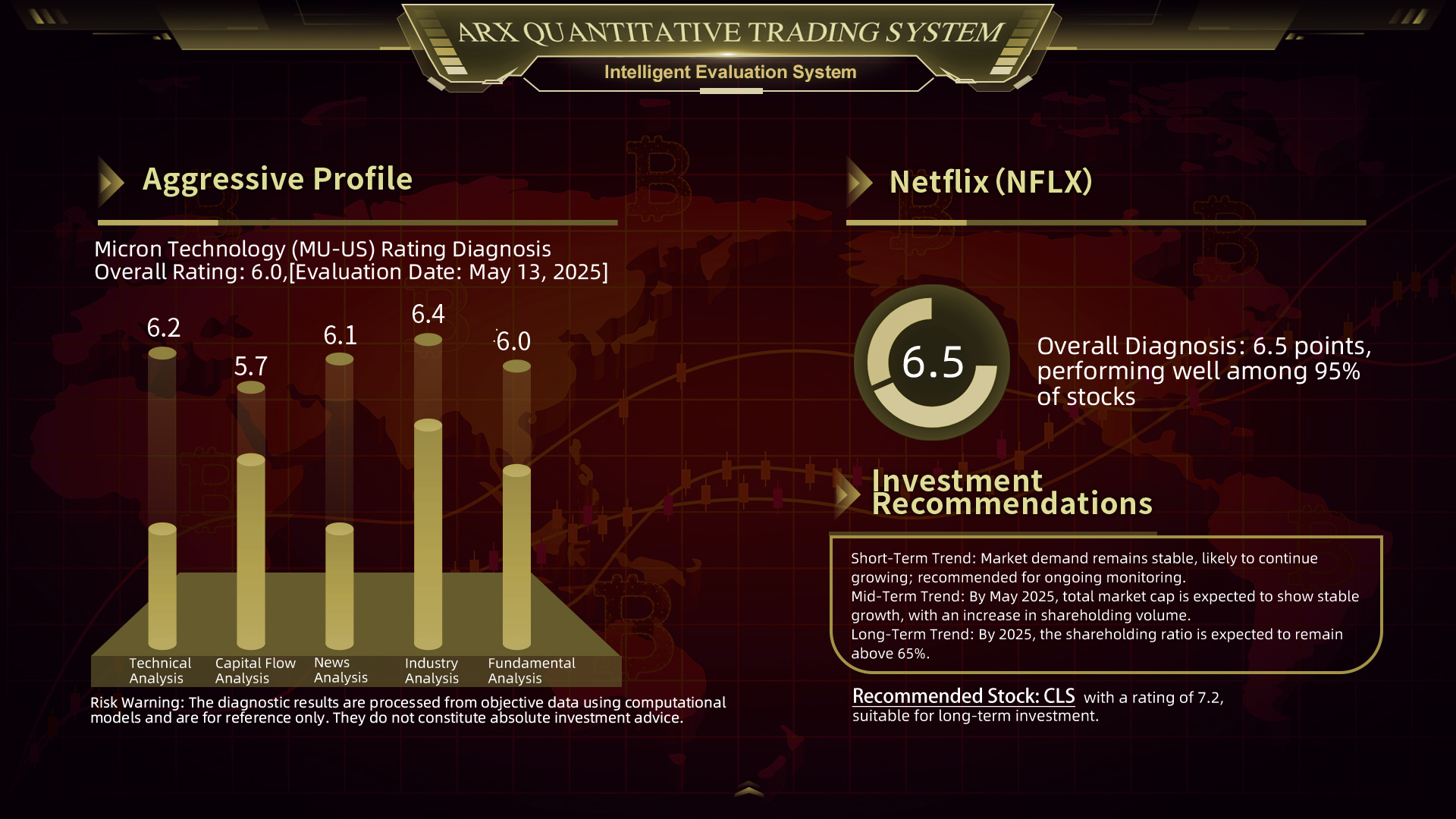

Feature 6: Intelligent Evaluation System

Traditional financial tools often lack comprehensive, all-asset-category analysis capabilities, making it difficult for investors to gain a broad perspective of market trends. This can lead to missed opportunities or hidden risks, affecting asset allocation efficiency and return performance.

MEET US

Feature 7: One-Click Intelligent Custody System

Ordinary investors often miss trading opportunities or make operational mistakes due to time and emotional constraints, leading to inefficient fund utilization and increased risks. Additionally, the complexity of managing diversified assets can affect overall returns and user experience.

NEW SERVICE

Feature 8: Global Risk Warning System

risk forecasting tools and real-time data support, leading to delayed reactions and significant losses during market turbulence. Institutional investors, on the other hand, leverage advanced risk models for proactive positioning

MEET US

Feature 9: Eternal Advisor System

In traditional asset management, investors often lack long-term companionship and behavioral tracking mechanisms, making it difficult to develop disciplined investment habits